All Categories

Featured

Table of Contents

On the other hand, if a customer needs to provide for an unique demands child who might not have the ability to handle their own money, a trust fund can be added as a recipient, enabling the trustee to manage the distributions. The sort of beneficiary an annuity owner picks impacts what the beneficiary can do with their inherited annuity and how the proceeds will certainly be taxed.

Lots of contracts permit a spouse to establish what to do with the annuity after the proprietor passes away. A partner can change the annuity agreement into their name, thinking all rules and civil liberties to the initial contract and postponing instant tax obligation repercussions (Immediate annuities). They can collect all continuing to be settlements and any type of survivor benefit and select recipients

When a partner becomes the annuitant, the partner takes over the stream of payments. Joint and survivor annuities likewise enable a named beneficiary to take over the contract in a stream of payments, rather than a swelling sum.

A non-spouse can just access the designated funds from the annuity proprietor's first agreement. Annuity proprietors can pick to designate a count on as their recipient.

What does an Flexible Premium Annuities include?

These distinctions assign which beneficiary will get the entire death advantage. If the annuity proprietor or annuitant passes away and the primary beneficiary is still active, the main recipient obtains the fatality advantage. If the primary beneficiary predeceases the annuity proprietor or annuitant, the fatality advantage will go to the contingent annuitant when the owner or annuitant dies.

The proprietor can change beneficiaries at any time, as long as the contract does not need an irreversible beneficiary to be named. According to professional contributor, Aamir M. Chalisa, "it is very important to understand the importance of assigning a recipient, as picking the incorrect recipient can have serious effects. Much of our customers select to name their underage kids as recipients, commonly as the primary recipients in the absence of a spouse.

Owners that are wed ought to not assume their annuity immediately passes to their partner. Usually, they go through probate. Our brief quiz offers quality on whether an annuity is a clever option for your retired life profile. When selecting a recipient, consider variables such as your relationship with the person, their age and exactly how acquiring your annuity might impact their economic scenario.

The recipient's partnership to the annuitant typically establishes the rules they comply with. As an example, a spousal beneficiary has more alternatives for handling an acquired annuity and is dealt with even more leniently with taxation than a non-spouse recipient, such as a kid or other relative. Income protection annuities. Intend the proprietor does decide to call a child or grandchild as a beneficiary to their annuity

What is included in an Annuity Accumulation Phase contract?

In estate preparation, a per stirpes classification specifies that, must your beneficiary pass away prior to you do, the recipient's offspring (children, grandchildren, and so on) will receive the death benefit. Attach with an annuity professional. After you have actually selected and named your beneficiary or recipients, you must continue to review your choices at the very least annually.

Keeping your classifications up to day can guarantee that your annuity will be managed according to your desires must you pass away suddenly. A yearly evaluation, significant life occasions can trigger annuity proprietors to take one more appearance at their beneficiary options.

Who has the best customer service for Annuity Riders?

Just like any type of economic product, looking for the aid of a financial advisor can be useful. A monetary coordinator can guide you via annuity administration processes, consisting of the approaches for updating your agreement's beneficiary. If no recipient is called, the payment of an annuity's survivor benefit goes to the estate of the annuity holder.

To make Wealthtender totally free for readers, we make cash from advertisers, including monetary specialists and companies that pay to be included. This creates a dispute of interest when we prefer their promo over others. Wealthtender is not a customer of these financial solutions service providers.

As a writer, it's one of the very best praises you can provide me. And though I really appreciate any of you investing a few of your hectic days reviewing what I write, clapping for my short article, and/or leaving appreciation in a comment, asking me to cover a subject for you genuinely makes my day.

It's you saying you trust me to cover a topic that is essential for you, which you're certain I would certainly do so better than what you can already locate online. Pretty heady stuff, and an obligation I don't take most likely. If I'm not knowledgeable about the subject, I investigate it on the internet and/or with calls that recognize even more concerning it than I do.

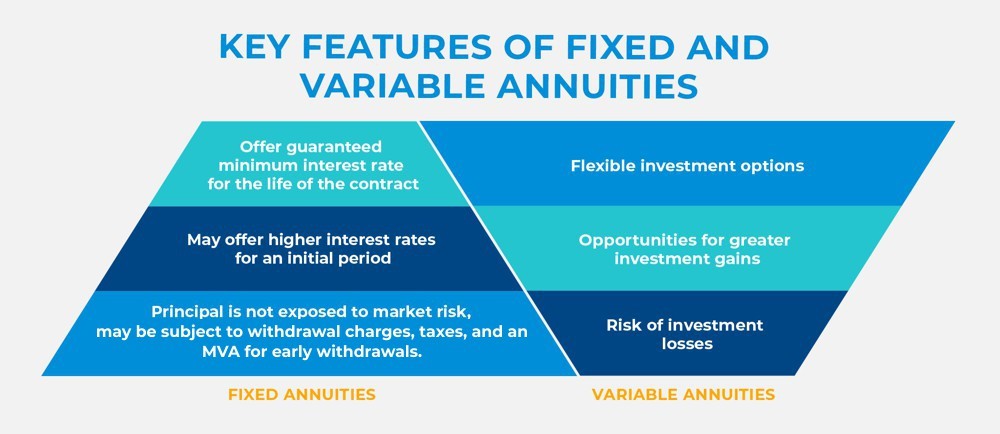

What are the benefits of having an Fixed Annuities?

Are annuities a valid referral, a shrewd move to secure surefire revenue for life? In the simplest terms, an annuity is an insurance coverage item (that just qualified representatives may sell) that assures you regular monthly payments.

This usually applies to variable annuities. The even more cyclists you tack on, and the much less risk you're eager to take, the lower the payments you must anticipate to get for a given premium.

Who offers flexible Annuity Investment policies?

Annuities chose appropriately are the ideal choice for some people in some scenarios. The only method to recognize without a doubt if that includes you is to first have a comprehensive financial plan, and after that determine if any annuity alternative uses sufficient benefits to validate the expenses. These prices consist of the dollars you pay in costs obviously, yet additionally the opportunity cost of not spending those funds in different ways and, for a number of us, the influence on your ultimate estate.

Charles Schwab has a great annuity calculator that reveals you around what repayments you can get out of taken care of annuities. I used the calculator on 5/26/2022 to see what a prompt annuity could payment for a solitary costs of $100,000 when the insured and spouse are both 60 and reside in Maryland.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Features of Variable Annuity Vs Fixed Annuity Why Deferred Annuity Vs Variabl

Decoding Tax Benefits Of Fixed Vs Variable Annuities Everything You Need to Know About Fixed Income Annuity Vs Variable Annuity What Is the Best Retirement Option? Features of Smart Investment Choices

Breaking Down Your Investment Choices A Closer Look at Variable Annuity Vs Fixed Annuity Breaking Down the Basics of Fixed Annuity Vs Equity-linked Variable Annuity Advantages and Disadvantages of Dif

More

Latest Posts