All Categories

Featured

Table of Contents

Trustees can be household members, trusted people, or monetary organizations, depending on your preferences and the intricacy of the trust fund. The objective is to ensure that the depend on is well-funded to meet the child's long-lasting financial demands.

The role of a in a youngster support count on can not be understated. The trustee is the specific or organization accountable for managing the trust fund's properties and guaranteeing that funds are distributed according to the regards to the count on contract. This consists of ensuring that funds are used entirely for the youngster's benefit whether that's for education, healthcare, or everyday expenditures.

They have to additionally provide routine reports to the court, the custodial parent, or both, depending upon the terms of the trust. This liability makes sure that the trust is being taken care of in a way that benefits the child, stopping misuse of the funds. The trustee also has a fiduciary duty, implying they are legally obligated to act in the very best rate of interest of the child.

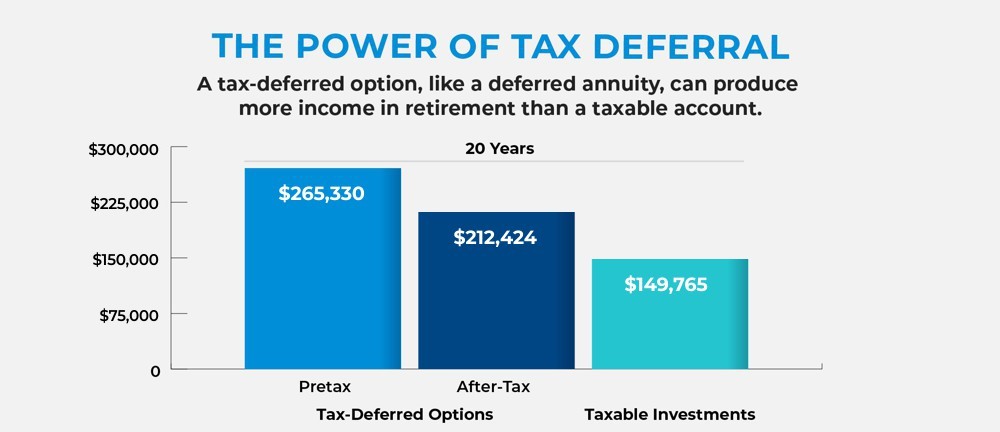

By acquiring an annuity, moms and dads can guarantee that a repaired quantity is paid frequently, despite any fluctuations in their earnings. This supplies assurance, recognizing that the youngster's demands will certainly proceed to be satisfied, no issue the monetary conditions. Among the crucial advantages of using annuities for kid assistance is that they can bypass the probate procedure.

How do I receive payments from an Annuity Investment?

Annuities can also provide security from market changes, making certain that the child's financial support stays steady also in unpredictable economic problems. Annuities for Child Assistance: A Structured Service When establishing, it's essential to take into consideration the tax ramifications for both the paying parent and the child. Trust funds, depending on their structure, can have various tax therapies.

In various other situations, the recipient the child may be liable for paying taxes on any kind of circulations they obtain. can likewise have tax obligation ramifications. While annuities give a stable earnings stream, it is very important to understand exactly how that earnings will be tired. Depending on the framework of the annuity, settlements to the custodial parent or youngster may be considered gross income.

Among the most significant benefits of using is the capacity to shield a child's economic future. Counts on, particularly, supply a degree of security from financial institutions and can make certain that funds are utilized properly. A depend on can be structured to make certain that funds are only utilized for particular objectives, such as education and learning or health care, avoiding misuse.

Annuity Income

No, a Texas child support count on is especially designed to cover the child's essential needs, such as education, health care, and everyday living expenditures. The trustee is lawfully obligated to ensure that the funds are used exclusively for the benefit of the youngster as outlined in the depend on contract. An annuity supplies structured, predictable settlements gradually, ensuring constant financial backing for the kid.

Yes, both child assistance counts on and annuities come with potential tax effects. Depend on earnings might be taxable, and annuity repayments might likewise go through tax obligations, depending upon their structure. It's crucial to speak with a tax obligation expert or economic expert to comprehend the tax obligation duties related to these monetary devices.

Annuity Withdrawal Options

Download this PDF - View all Publications The elderly person population is large, growing, and by some quotes, hold two-thirds of the private wealth in the USA. By the year 2050, the number of senior citizens is projected to be virtually twice as large as it remained in 2012. Since many seniors have had the ability to conserve up a savings for their retirement years, they are commonly targeted with fraudulence in a manner that younger individuals without any financial savings are not.

The Attorney General supplies the adhering to pointers to think about before purchasing an annuity: Annuities are complex investments. Annuities can be structured as variable annuities, dealt with annuities, instant annuities, delayed annuities, and so on.

Consumers must check out and comprehend the syllabus, and the volatility of each financial investment provided in the syllabus. Capitalists need to ask their broker to discuss all terms and problems in the syllabus, and ask questions regarding anything they do not recognize. Repaired annuity items may additionally bring risks, such as long-lasting deferment durations, barring investors from accessing every one of their cash.

The Attorney General has actually filed claims against insurance policy firms that offered improper postponed annuities with over 15 year deferment periods to financiers not anticipated to live that long, or that need access to their cash for healthcare or assisted living expenses (Annuity investment). Financiers need to ensure they understand the long-term repercussions of any kind of annuity purchase

Can I get an Long-term Care Annuities online?

Beware of workshops that use totally free meals or presents. In the end, they are rarely complimentary. Beware of agents that provide themselves phony titles to improve their integrity. The most considerable charge connected with annuities is often the abandonment cost. This is the portion that a consumer is billed if she or he takes out funds early.

Customers may want to get in touch with a tax consultant before spending in an annuity. The "safety and security" of the financial investment depends on the annuity.

Agents and insurance provider may supply rewards to attract investors, such as extra interest factors on their return. The benefits of such "rewards" are often outweighed by enhanced costs and administrative expenses to the investor. "Bonuses" may be just marketing gimmicks. Some deceitful agents urge consumers to make impractical financial investments they can't afford, or acquire a long-lasting deferred annuity, despite the fact that they will certainly require accessibility to their money for wellness care or living expenditures.

This section provides information valuable to retirees and their households. There are many events that may impact your advantages. Gives details frequently asked for by brand-new retirees consisting of altering health and wellness and life insurance policy choices, COLAs, annuity settlements, and taxable parts of annuity. Explains just how benefits are influenced by occasions such as marriage, separation, fatality of a spouse, re-employment in Federal solution, or inability to handle one's financial resources.

How do I apply for an Lifetime Income Annuities?

Secret Takeaways The recipient of an annuity is an individual or organization the annuity's owner marks to get the contract's death benefit. Various annuities pay to beneficiaries in different methods. Some annuities might pay the beneficiary stable repayments after the agreement holder's fatality, while other annuities might pay a fatality benefit as a lump amount.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Features of Variable Annuity Vs Fixed Annuity Why Deferred Annuity Vs Variabl

Decoding Tax Benefits Of Fixed Vs Variable Annuities Everything You Need to Know About Fixed Income Annuity Vs Variable Annuity What Is the Best Retirement Option? Features of Smart Investment Choices

Breaking Down Your Investment Choices A Closer Look at Variable Annuity Vs Fixed Annuity Breaking Down the Basics of Fixed Annuity Vs Equity-linked Variable Annuity Advantages and Disadvantages of Dif

More

Latest Posts